The Polyamide Market Outlook remains one of the most critical discussions in the chemicals and materials industry, as polyamides (PAs) serve as essential engineering thermoplastics used in a wide range of applications, from automotive parts to textiles and electronics. As of 2023, the global polyamide production capacity was approximately 15,300 KT, and this is expected to grow to 17,800 KT by 2032, reflecting an upward trajectory driven by rising demand in diverse sectors. The Asia Pacific region holds a dominant share, accounting for more than 50% of global polyamide production capacity, with China being the leader in the production of PA 66, while North America leads in the production of PA 6. Additionally, the polyamide plant capacity utilization stood at 55% in 2023, indicating considerable growth potential in the coming years. This article will explore the key dynamics of the polyamide market, analyzing the supply and demand factors, technological innovations, regional trends, and future prospects.

Understanding Polyamide: A Brief Overview

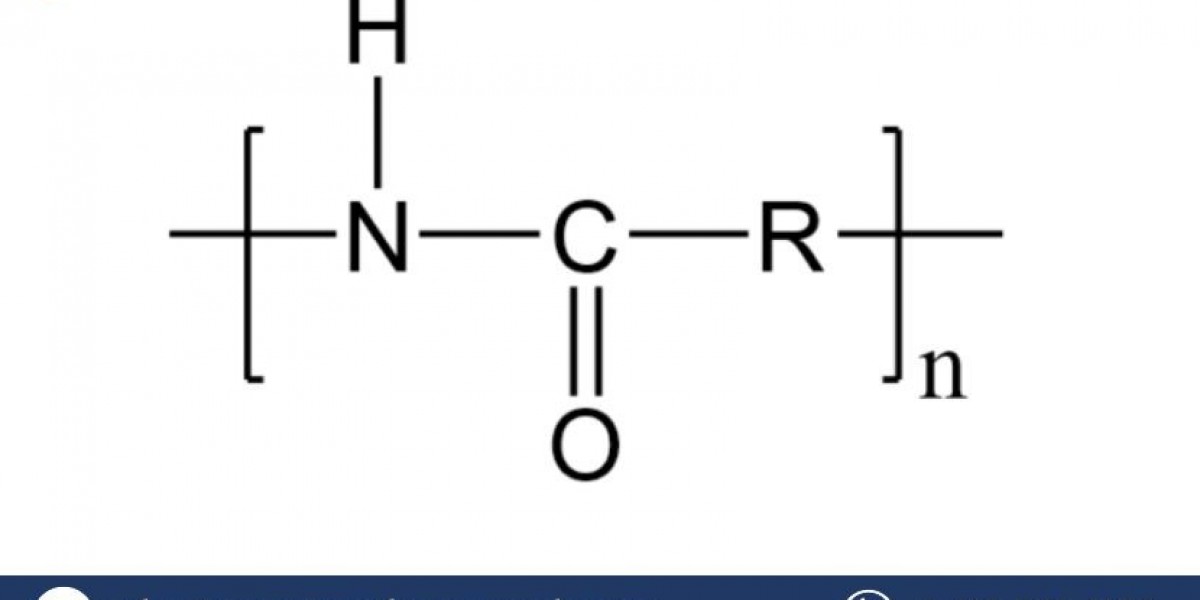

Polyamide, commonly known as nylon, is a family of synthetic polymers widely recognized for their strength, durability, and versatility. Polyamides are primarily used in the production of textiles, automotive parts, electrical components, and industrial applications. The most common forms of polyamide are PA 6 (Nylon 6) and PA 66 (Nylon 66), each with distinct properties and applications. PA 6 is known for its excellent balance of properties such as high mechanical strength, chemical resistance, and thermal stability, while PA 66 offers superior heat resistance, higher strength, and improved wear properties. Both types are integral to the modern manufacturing landscape, with applications ranging from fibers in fabrics to engineering plastics used in automotive components.

Global Polyamide Supply and Demand Dynamics

Supply Side: Key Production Regions and Manufacturers

The global polyamide production is heavily concentrated in the Asia Pacific region, which accounts for more than 50% of the total polyamide production capacity. China, in particular, holds a significant position in the global market as the largest manufacturer of PA 66. The country’s vast manufacturing infrastructure, coupled with its rapid industrialization and automotive production, has positioned it as a leader in polyamide production. Additionally, China has invested heavily in technology to meet growing domestic and international demand.

In North America, PA 6 is predominantly produced, with the region being home to some of the world’s largest producers of polyamide, such as BASF and Invista. The North American polyamide market has seen growth driven by the automotive and electronics sectors, where PA 6 is used for manufacturing lightweight, high-performance components.

Other key polyamide-producing regions include Europe and the Middle East, with Europe being a leader in high-quality polyamide products used in demanding applications, such as aerospace and electronics.

The global polyamide production capacity was estimated at 15,300 KT in 2023, and this is expected to grow at a compound annual growth rate (CAGR) of approximately 2.3% to reach 17,800 KT by 2032. This growth is driven by expanding demand across automotive, textile, electronics, and industrial sectors.

Get a Free Sample Report with Table of Contents@

https://www.expertmarketresearch.com/industry-statistics/polyamide-market/requestsample

Demand Side: Industries Driving Polyamide Consumption

The polyamide market is primarily driven by its wide range of applications in various industries, including automotive, textiles, electronics, and industrial engineering. Each of these industries contributes significantly to polyamide consumption.

Automotive Industry: The demand for lightweight and fuel-efficient materials in the automotive industry has led to the increasing use of polyamides. PA 6 and PA 66 are used extensively in the production of under-the-hood components, including air intake manifolds, engine covers, and electrical connectors. The automotive industry’s push toward reducing carbon emissions and improving fuel efficiency has further accelerated the adoption of polyamide-based materials, as they provide an excellent alternative to metal parts.

Textile Industry: Polyamide fibers, especially PA 6 and PA 66, are extensively used in the textile sector for manufacturing apparel, upholstery, and technical fabrics. With the growing demand for performance fabrics, such as activewear, polyamide-based materials are favored due to their strength, elasticity, and resistance to abrasion and chemicals. In addition, the rise of sustainability and eco-conscious fashion trends has increased demand for recycled polyamides, adding to market growth.

Electronics and Electrical Applications: In the electronics and electrical industries, polyamides are used to produce insulating materials for wires, connectors, and circuit boards. PA 6 and PA 66 offer excellent electrical insulation properties, making them ideal for use in electronic devices, from consumer electronics to industrial machinery. As electronic products become increasingly complex and compact, polyamide's role in ensuring safety and performance in electrical systems continues to expand.

Industrial Applications: Polyamides are also in high demand for industrial applications due to their superior mechanical strength and chemical resistance. They are used in the production of industrial gears, bearings, conveyor belts, and other mechanical components that require durability under harsh conditions.

Polyamide Plant Capacity Utilization and Market Balance

In 2023, polyamide plant capacity utilization stood at 55%, reflecting an underutilization of production capacity across the global market. This relatively low utilization rate suggests that there is significant room for growth in production capacity, particularly as demand continues to rise in the automotive, textiles, and electronics industries. The underutilization of capacity also points to potential opportunities for new plant developments, particularly in emerging markets in Asia and Latin America.

However, regional imbalances persist in the supply and demand dynamics of polyamide. While regions like Asia and North America have robust production capacities, other regions such as Latin America and parts of Europe are more reliant on imports. This imbalance creates both challenges and opportunities for the global polyamide trade, with fluctuating prices and trade agreements affecting market stability.

Technological Advancements and Innovations in Polyamide Production

The polyamide market is evolving due to technological innovations that are enhancing the efficiency and sustainability of production processes. The development of high-performance polyamides, such as polyamide 12 (PA 12), which offers excellent chemical resistance and low moisture absorption, is gaining traction in industries such as automotive and electronics.

Additionally, advancements in recycling technologies for polyamide are transforming the market. With increasing demand for sustainable materials, the focus on recycling and circular economy models is expected to expand. Companies like Aquafil are leading the charge by producing regenerated polyamide from post-consumer waste, particularly in the textile industry, which helps reduce environmental impacts while meeting the growing demand for polyamide products.

Another key development in the polyamide market is the use of bio-based feedstocks for production. Companies are exploring the use of renewable raw materials, such as plant-based oils, to produce polyamide resins. These bio-based polyamides aim to reduce the reliance on fossil fuels and contribute to more sustainable manufacturing practices.

Future Outlook and Market Challenges

The polyamide market is expected to continue its growth trajectory, driven by increasing demand across various industries. By 2032, the global polyamide production capacity is projected to reach 17,800 KT, marking a significant increase from 2023 levels. However, there are several challenges that could affect the market's growth:

Supply Chain Volatility: The global polyamide market faces challenges related to supply chain volatility, especially in the sourcing of raw materials and shipping. Fluctuations in raw material prices, such as adipic acid and caprolactam, can affect production costs and market pricing.

Environmental Regulations: As the demand for sustainable practices grows, polyamide manufacturers will need to comply with stricter environmental regulations. The transition to more sustainable production processes, such as bio-based polyamides and recycling technologies, will be crucial in mitigating the environmental impact of polyamide production.

Geopolitical Instability: Geopolitical tensions and trade disputes can also disrupt the polyamide supply chain, particularly in regions where production is concentrated. Shifting trade policies, tariffs, and import-export regulations may impact market dynamics, particularly in Asia and North America.

Related Reports

https://www.expertmarketresearch.com/blogs/top-auto-parts-manufacturing-companies

https://www.expertmarketresearch.com/blogs/top-smartphones-companies

https://www.expertmarketresearch.com/blogs/top-military-drone-manufacturers

Media Contact

Company Name: Claight Corporation

Contact Person: Peter Fernandas, Corporate Sales Specialist

Email: [email protected]

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com